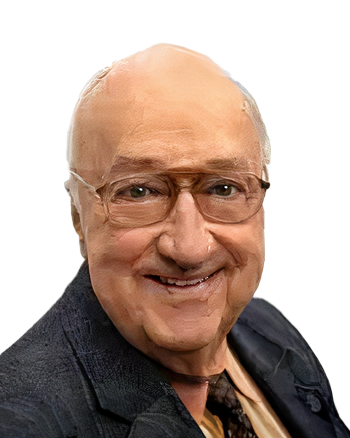

Utah's Trusted Mortgage Brokers

Want your dream home? We can help. Altius Mortgage makes buying, refinancing, or investing in a home easy. Our experienced team is here to guide you through every step of the process, ensuring you understand your options and make the best decisions for your financial future. As one of the leading mortgage companies in Utah, we offer a wide range of loan products, including conventional loans, FHA, VA loans, and more. Our mortgage brokers in Draper, UT, will work closely with you to understand your financial needs and find the perfect loan for you. We pride ourselves on our customer service and dedication to helping you find the best home mortgage in Utah.

Excellent 4.9 out of 5

Network of 30+ Top National Lenders

Home Loans

Made Easy With Altius

Find Your Loan Officer

Home Loan Options

Your Home, Your Loan.

Need a home loan? We offer many types of loans to fit your needs and budget, including conventional, FHA, VA, and USDA. Let Altius Mortgage find the perfect loan for you.

Construction Loans

A construction loan is a short-term financing option specifically tailored for funding the construction of a new home. Unlike traditional mortgages, which are disbursed in a lump sum, construction loans are released in phases, corresponding to the completion of specific construction milestones. This approach ensures that funds are used wisely and allocated as needed throughout the building process.

Reverse Mortgages

Down Payment Assistance

Debt Consolidation

Are you feeling overwhelmed by multiple debts and looking for a way to manage your finances more effectively? At Altius Mortgage, we understand how stressful it can be to juggle various loans and credit card payments. Based in Draper, UT, we’re proud to offer our expert debt consolidation services to Salt Lake City residents and help you regain control of your financial future.

Non-QM Loans

Focuses on offering loan options for borrowers with non-traditional income sources or credit challenges, ensuring broader accessibility to home financing.

Loan Programs for Investors

Catering specifically to real estate investors, these programs offer financing solutions for investment properties, including rental and resale ventures.

Home Purchase Loans

Refinancing Solutions

First-Time Homebuyer Programs

Specialized services designed to assist first-time buyers, including educational resources and down payment assistance, to make the home buying process more accessible and manageable.

Frequently Asked Questions

First Time Home Buyers

To qualify, you typically need a credit score of at least 620, a stable income, and a debt-to-income ratio lower than 43%. Some programs allow lower credit scores or DTIs.

Programs include FHA loans with lower down payments, USDA loans for rural homes, VA loans for veterans, and local first-time buyer assistance programs offering grants or down payment assistance.

Down payments can range from 0% (VA and USDA loans) to 3.5% (FHA loans) and up to 20% for conventional loans, depending on the loan type and your credit situation.

Advantages include access to special loan programs, lower down payments, potential tax benefits, and various state or local grants and programs designed to help first-time buyers.

Understand your budget, get pre-approved for a mortgage, research neighborhoods, hire a real estate agent, and be prepared for closing costs and other expenses beyond the down payment.

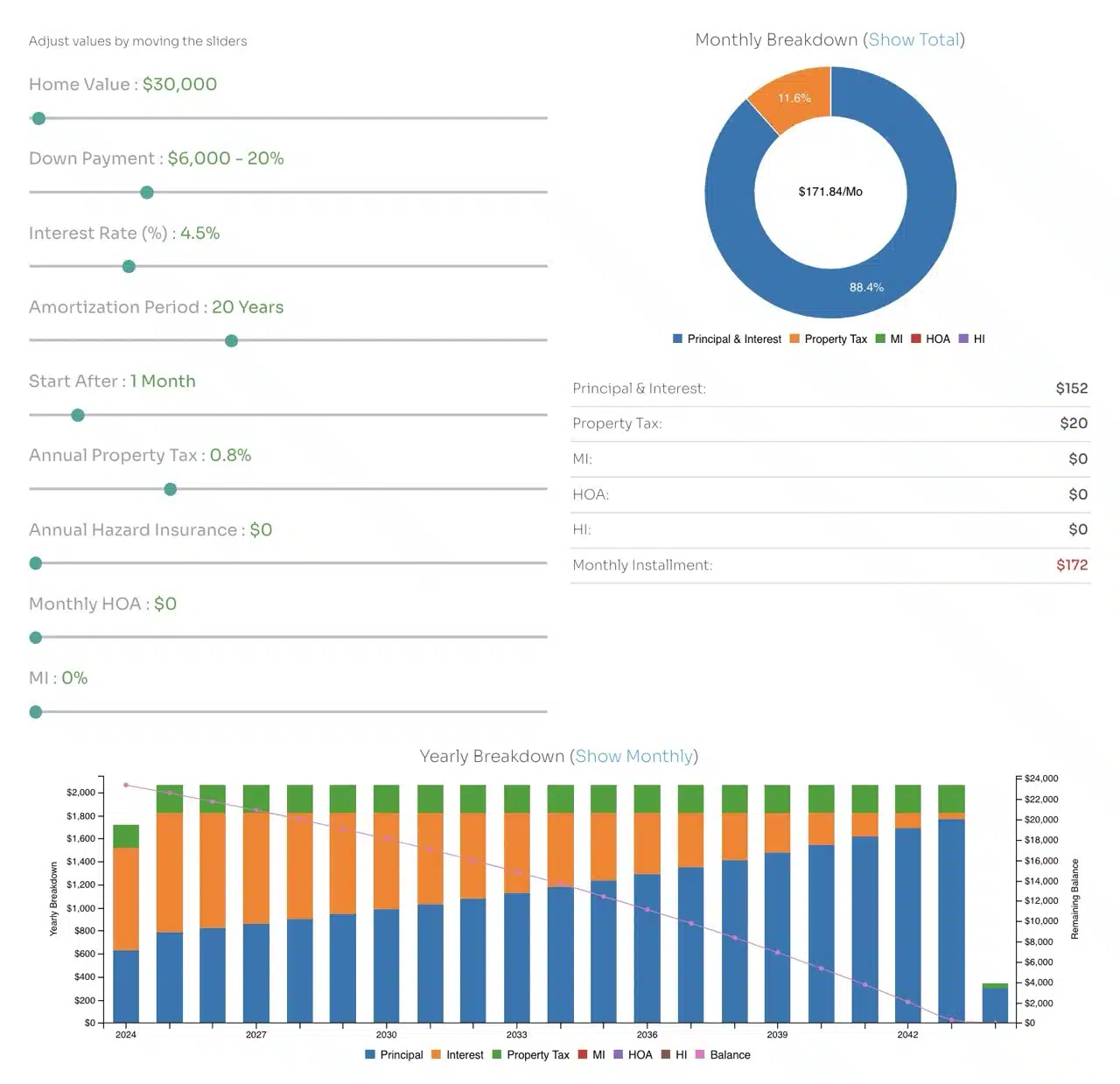

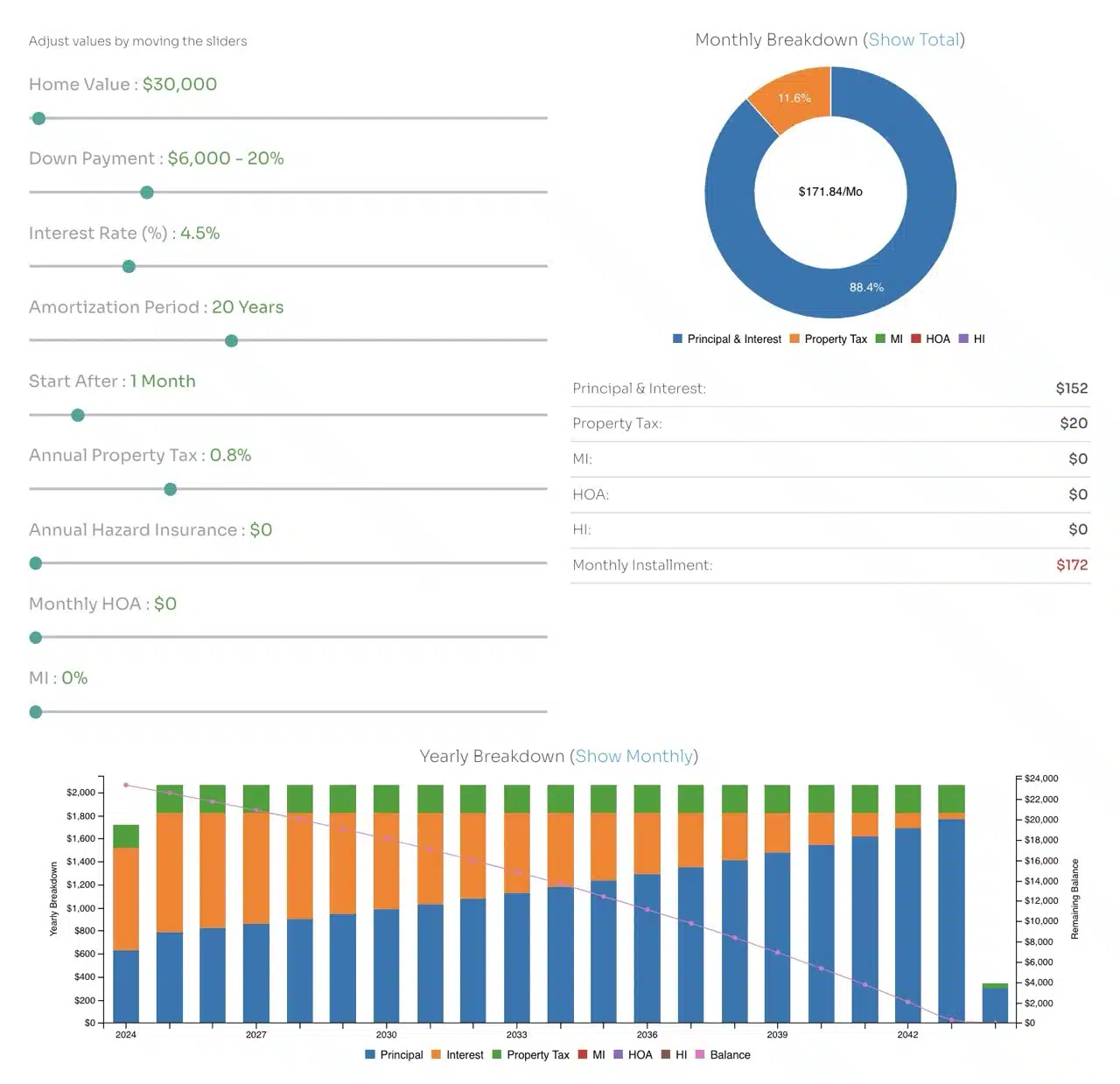

Altius Mortgage Calculator

Get in touch!

Your Dream of Home Ownership is within Reach.